Why Am I Paying $40,000 for the Birth of My Child?

The healthcare market is taxing reproduction out of existence.

I had never heard of Michael Green before his now-infamous essay “Part 1: My Life Is a Lie - How a Broken Benchmark Quietly Broke America” went extremely viral on X.

Go read it. The short version: real poverty is closer to $140,000 than $31,000.

“The U.S. poverty line is calculated as three times the cost of a minimum food diet in 1963, adjusted for inflation.”

and

The composition of household spending transformed completely. In 2024, food-at-home is no longer 33% of household spending. For most families, it’s 5 to 7 percent.

Housing now consumes 35 to 45 percent. Healthcare takes 15 to 25 percent. Childcare, for families with young children, can eat 20 to 40 percent.

If you keep Orshansky’s logic—if you maintain her principle that poverty could be defined by the inverse of food’s budget share—but update the food share to reflect today’s reality, the multiplier is no longer three.

It becomes sixteen.

Which means if you measured income inadequacy today the way Orshansky measured it in 1963, the threshold for a family of four wouldn’t be $31,200.

It would be somewhere between $130,000 and $150,000.

And remember: Orshansky was only trying to define “too little.” She was identifying crisis, not sufficiency. If the crisis threshold—the floor below which families cannot function—is honestly updated to current spending patterns, it lands at $140,000.

This article resonated with me because I have had three children born since 2021 - well, technically, my third arrives in a week.

I have spent $30,000, $35,000, and now $40,000 for each child delivered.

That is my full out-of-pocket cash-paid cost as a self-employed entrepreneur who runs a small business. I do not have a corporate daddy to share costs with me. This is totally unsustainable and insane, yet every central bank-worshipping think tank economist who attacked Green had nothing to say when I asked them to justify my socialized cost for the public good of bringing a new tax-payer into this world.

America has a cost of living crisis; it’s not being taken seriously by “serious” economists; and the ongoing failure to address it will lead to political, social, and economic calamity.

The Absurd Participation Costs of Child Birth

The essential theme of Green’s piece is that “participation costs” - the price of admission you pay to simply be in the market, let alone win, have grown out of control. Food and shelter are participation costs for living. Having a $200/mo smartphone is now a participation cost for many things such as getting access to your banking information remotely, medical records, and work / school.

There’s no greater “participation cost” to human civilization than reproduction.

My Situation

I run Petabridge - we’re a small, specialized software company. I have fewer than 5 employees and I own 100% of the company. Been in business for 11 years. I love what I do. We’re too small for most traditional insurance brokers / group marketplaces but use TriNet, one of the largest Professional Employment Organizations (PEO)s in the United States, to handle payroll / taxes / benefits. I also used them when I ran MarkedUp, my last company before Petabridge.

My wife and I got married in 2020 and she became a full-time home maker, so I’m the sole bread winner.

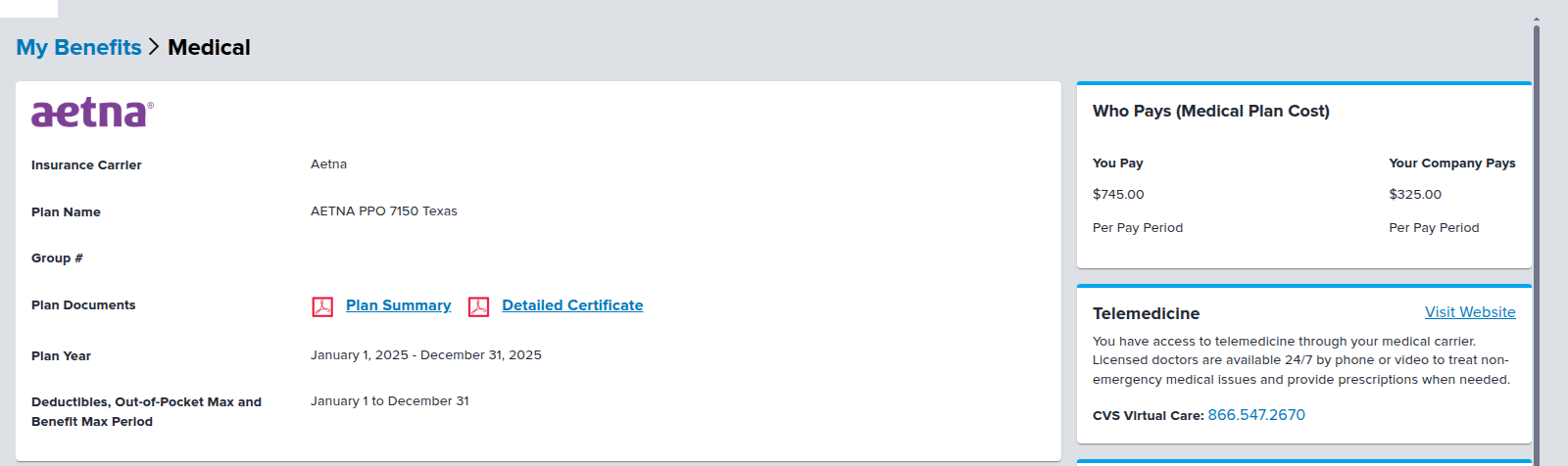

This is what my current health care costs look like per pay period, which is bimonthly.

Remember, I own 100% of the company - so it makes no real difference which side of the ledger the money comes from. I pay the full freight.

745 + 325 = $1070 per pay period

$1070 x 2 pay periods per month = $2140 per month

$2140 x 12 months = $25,680 annual health insurance premium

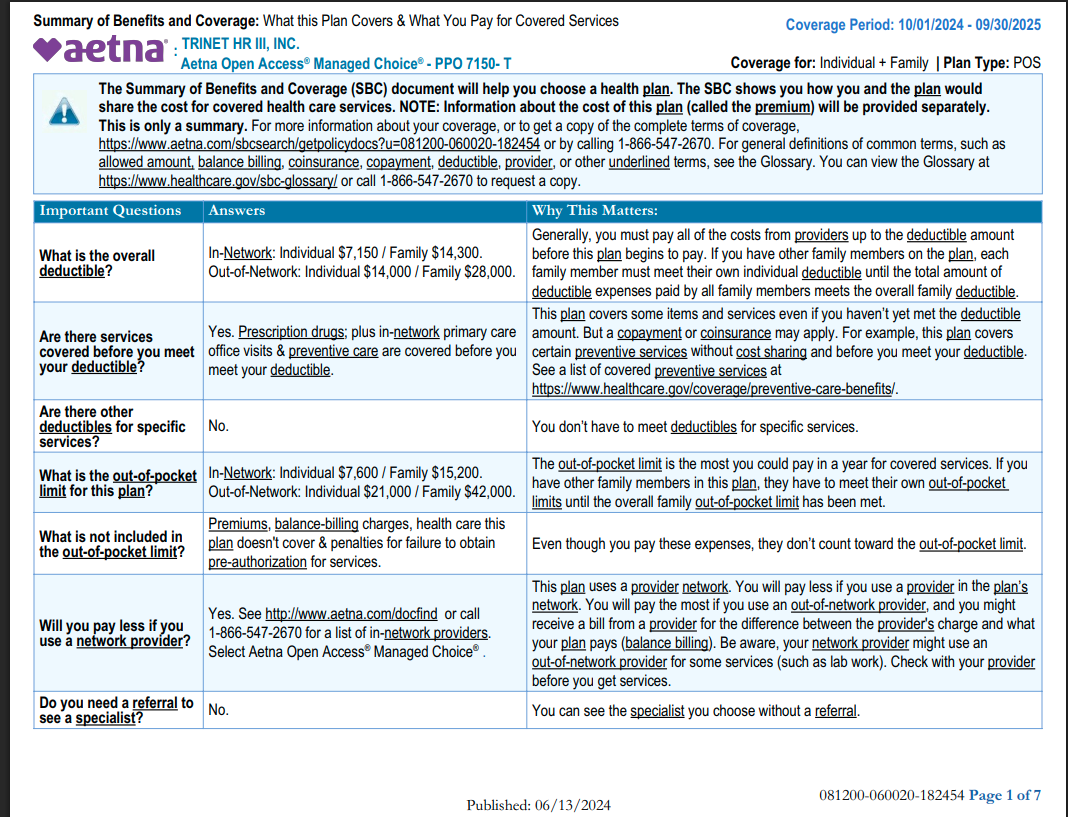

Before any of those magic benefits kick in though, there’s the sticky issue of my health insurance deductible:

I have to hit a $14,300 deductible first, which I will absolutely hit next week when my child is delivered (if I haven’t already.)

$25,680 premium + $14,300 deductible = $39,980 annual cost

Thus I’ll spend $39,980 bringing my new daughter into this world in 2025, and there are assuredly things I’ve paid for that are not covered by insurance either (i.e. we paid for some tests and sonograms that aren’t covered at all by our plan) - so the real cost will be $40k+ when it’s all said and done.

Here’s what my insurance premiums look like for 2026:

$1216.50 per pay period x 2 = $2433 per month

$2433 x 12 = $29,196 annual health insurance premium

The deductible is staying the same at $14,300, so now my max spend is $43,496 - an 8.8% increase in total cost over the previous year, but a 13.6% increase in premiums. I’ve had some version of this plan for about 5 years and this price increase has been fairly consistent over time - I think I was paying $1850 a month in premiums back in 2021, which was more than my mortgage.

PEO Fees

My actual insurance cost is somewhat higher than the $40,000 I’ve laid out here.

I also pay $1250 per month to TriNet for the privilege of being able to buy their health insurance in the first place - sure, I get some other benefits too, but I’m the only US-based employee currently so this overhead is really 100% me. The only reason I stick with TriNet and don’t replace them with a significantly cheaper payroll processor like QuickBooks Payroll is for access to their health insurance benefits.

So my real participation cost is closer to $55,000 a year - the healthcare market is socializing enormous costs to me for public service of siring new taxpayers.

Broken Markets

The normal health insurance markets:

- Big employers;

- Health young people who can participate in Obamacare / eHealth Insurance (individual) markets1; and

- Poor people who get either subsidized ACA plans or Medicaid.

I have the misfortune of creating jobs for other people, so option 1 is out.

My wife and I are healthy, but we’re building our family and I have yet to see a marketplace plan that supports child-birth. Maybe the subsidized ones do, but I earn too much money to see those. All of the ones I’ve found through eHealth Insurance or Healthcare.gov never cover it - and I check every year. So options 2 and 3 are out. This leaves me with few options to continue running my company AND grow a family at the same time.

The Affordable Care Act (Obamacare) barred insurers from turning down applicants based on existing pre-conditions; the way insurers get around this for pregnancy and child-birth is not by rejecting pregnant applicants (illegal), but by simply refusing to cover the care those applicants need to survive pregnancy (legal and common.)

I’ve had the same version of this Aetna plan since late 2020 when my wife and I got married and she quit her job. It’s the cheapest PPO I can buy through TriNet that gives us access to our pediatrician and OBGYN. The other PPOs are significantly more expensive and usually have lower deductibles. The “cheaper” alternatives offered through TriNet are HMOs or EPOs that have some issues with them: co-insurance or none of our medical providers being in their network.

If you’re familiar with how healthcare charge masters work, then you’ll understand why co-insurance is a bad bet when you know for certain you’re going to need an expensive medical intervention (like child-birth.)

Earlier this month our 4 year old had a 15 minute procedure to treat bladder reflux - the “billed cost” to Aetna was roughly $32,000. That’s nowhere close to the “real” cost of the procedure, but the point stands: if you have a big medical event while you’re on co-insurance you might get exposed to the same heat levels that totally uninsured people have to tolerate.

I’ve also looked into buying plans directly from Aetna and other smaller brokers like SimplyInsured - similar problems there:

- Individual health insurance plans don’t support child birth or

- The costs are actually higher than what I’m already paying TriNet2.

It’s also worth noting, by the way, that TriNet’s quotes to me aren’t unique to my company, as far as I know. These are the standard plans TriNet offers to all Texas-based employers.

My Trade-Offs

My situation leaves me with unfavorable options:

- Continue paying through the nose for my Aetna PPO;

- Drop health insurance altogether; start negotiating cash settlements; and backstop my risk with a platform like CrowdHealth - this is more time-expensive and exposes us to risk, but it can be managed;

- Use an EPO / HMO and search for new health care providers who will accept these plans - we’ve looked and it’s bleak;

- Have my wife go find a BigCo corporate job somewhere and raise our children in daycare; or

- Destroy my firm and all of the economic value it creates to go get a BigCo job myself.

I’ve chosen number 1 because I have to negotiate the following trade-offs:

- Forcing my pregnant wife to find new pediatricians, OBGYN, GPs, et al for her and our children;

- The amount of time I can personally spend each November searching for alternatives - 10-30 hours each year usually;

- The amount of time I can personally spend negotiating health care costs - CrowdHealth might be able to help with that, but I’m extremely time-poor at the moment;

- The amount of uncapped financial exposure I’m willing to tolerate - this is why Aetna can get away with highway robbery in the first place - insurers like them incentivize the creation of this exposure risk through Chargemaster / discount games; and

- The amount of cash I am willing to pay for any of the above.

I am fortunate. I am a higher earner, so I can sign the enormous check each year. The real people who bear this cost though are the employees I’m not going to hire; I’m not going to spend $40-$100k an entry level software engineer / admin / SDR / marketer or whatever if I need to keep $55k in reserve to expand my family.

What if I was starting a solo plumbing business or a restaurant? What would my alternatives be then? What if I fell beneath the “$140k poverty line” but not low enough where I can qualify for Medicaid / CHIP / subsidized market plans? I’d be utterly screwed.

“Aha! But You Are Participating in the Market!?”

The problem I have with health insurance isn’t just the high price tag. It’s:

- The real lack of viable alternatives, making me feel robbed at gunpoint while watching my living standards or optionality on my own hard-fought business capital shrink each year.

- The societal absurdity of this situation - what civilization can survive such strong economic headwinds against the reproduction of its own populace? The health insurance market takes wealth from the young, healthy, and reproductive and transfers it as services to the old and dying. This is insane and unsustainable.

- The worst of all: I am old enough to remember health insurance markets not being this way, so I know things can be different.

The first thing I’d expect someone like Tyler Cowen to explain to me, upon reading this post, is to gaslight me about median healthcare costs and show me a chart of premiums staying stable in inflation-adjusted dollars - as though that does anything to solve my immediate problem of having to spend a sum of money that is higher than many American’s annual income in order to have my third child delivered.

You can make the argument that maybe I need to change my situation, but that argument is a total loser. “Just go back to work for Microsoft” or “don’t have three children” or “send your wife back to work” or “move away from your family3.”

If your answer to “I can’t afford to have children and run a business” is “then don’t,” you are building the political conditions for extremism. This is how every revolution starts: a critical mass of people who conclude the system offers them nothing worth preserving. They don’t just want change - they want revenge.

Economists and Wall Street big shots have not been remotely persuasive in making their case that “everyone is doing great in 2025, actually” because it runs completely afoul of most American’s recent experiences at the till, hence the high economic anxiety reflected in the polls.

Green writes a piece saying 140k is the new poverty line.

— Clifford Asness (@CliffordAsness) December 1, 2025

It’s thoroughly debunked.

And a legion of the credulous sycophants who dig the vibe ex post redefine poverty to ennui (the piece never would’ve gotten traction without the 140k poverty thing which we are now told is… https://t.co/LG2lQp2mgy

The reason why Mike Green’s piece resonated with so many is because this sentence perfectly captures what I and many others have been trying to do for the past five years:

“Become rich enough to ignore the cost” - that is exactly what I have been trying to do and it is daunting.

Per Jeff Bezos: “When the data and the anecdotes disagree, the anecdotes are usually right.”

I am tired of hearing economists tell me how great everything is by showing me a chart that doesn’t look anything like real life on the ground - that’s exactly how Biden got voted out on his ass and the same will happen to Trump if conditions don’t improve. My being unhappy with the status quo is not “populism” - it’s reality. And it sucks.

A society that makes it this hard to have children is a society that has decided it doesn’t want a future. I’m fighting for mine anyway.

In a week, I’ll hold my third child. I’ll sign the check. I’ll keep building my business. But I won’t pretend this is fine - and neither should you.

-

In 2012 I was an eHealth Insurance customer. I was 25 years old. I paid $150 a month in California for a much better BlueCross / BlueShield PPO than I have ever had since Obamacare went into effect in 2013. ↩

-

TriNet is a massive PEO that has thousands of employers using it for benefits administration, thus in theory it should get favorable pricing power with health insurers. ↩

-

I already did, once - from Los Angeles, CA to Houston, TX. My family moved here too for the same economic reasons. ↩